With so many insurance companies to choose from, policyholders benefit from the fierce competition between insurers over attracting and retaining new clients.

You don’t have to wait until your policy is up for renewal to ask about discounts. If you discover you can get better rates and discounts, move your policy to another auto insurance carrier right away.

How Car Insurance Rates Work

Are your insurance rates set by law? Yes and no. Car insurance rates are regulated by states, but if companies observe state laws, they are free to charge what they wish.

How is my car insurance rate set? You are sorted first into an individualized group – say, married drivers in your zip code over 25. Then the company calls up the pricing for that group. It adjusts for any negative factors, such as traffic violations or a pattern of claims. It considers the value of the car are you are insuring and the frequency of claims. Finally, any discounts you qualify for are subtracted from the price, and your quote is returned.

What affects the auto insurance rates quotes I receive?

- Who you are

- Your record

- What and how you drive

- How much coverage you want

- Your zip code

- Your age

- Your driving record

- Your credit

- Your previous insurance coverage

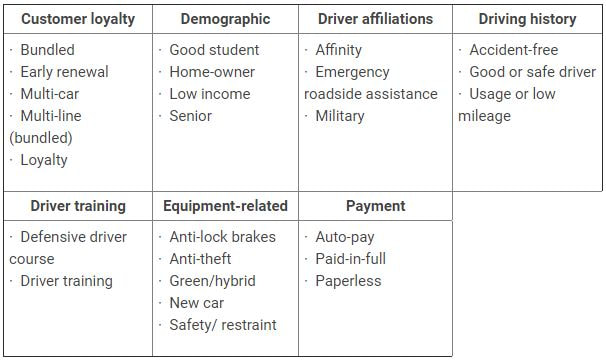

Types of Insurance discounts

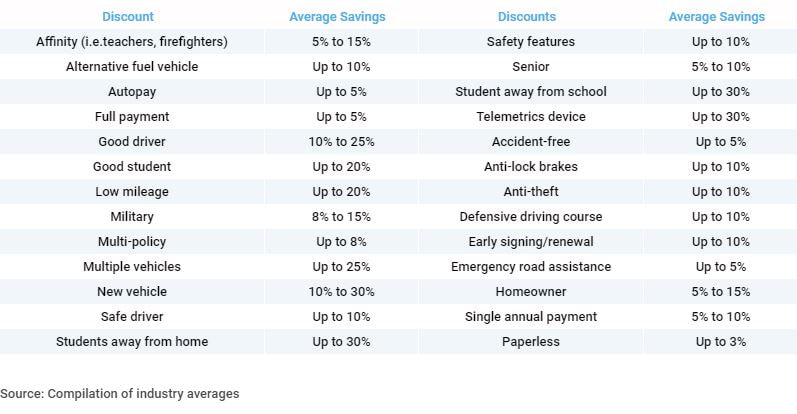

Auto insurance discount savings

It doesn’t matter how good a “deal” is if you get insufficient service. We can help you do the homework to find the best insurance that provides the coverage you need at the right price.

Have a safe and happy Labor Day weekend.

RSS Feed

RSS Feed