You can minimize your risk with knowledge and preparation. Learn about different flood risks, ways to protect your belongings and how to select the best coverage for you.

Who Needs Flood Insurance?

Standard home and renters’ insurance doesn’t cover damages caused by a flood. You’ll need a separate policy for that. Flood insurance covers flood damage to your home, personal belongings, and other structures on your property.

Renters and condo owners need flood insurance, too. Your building owner might have flood protection, but it only covers their building and rebuilding costs. It won’t help you replace your things. Condo and renters flood policies are inexpensive since they don’t cover rebuilding.

Know What Flood Policies Cover

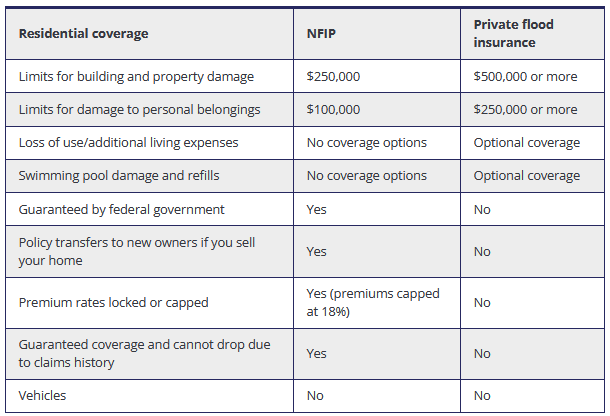

A growing mix of private insurance options and federally funded policies are available. Flood insurance coverage can get tricky. Government-backed policies like the National Flood Insurance Program (NFIP) and private flood insurance providers have their pros and cons.

Protect Your Property and Belongings

Regardless of your home’s flood rating, you should safeguard your property and belongings.

- Protect in-home electrical and climate systems

- Elevate outdoor equipment

- Modify water valves

- Inspect the perimeter

- Clean gutters, downspouts and drains

- Elevate storage items

- Fight soil erosion using landscaping

- Create barriers

Safeguard Essential Documents

Most people think about property damage during a flood. But you must also consider other risks, like damage to essential and hard-to-replace items. FEMA recommends keeping essentials in a grab-and-go bag if you need to leave in a hurry. Examples include:

- Prescriptions — Gather essential medicines, medical equipment, batteries, eyeglasses, hearing aids and other necessary medical items.

- Critical documents — Assemble hard and electronic copies of birth certificates, Social Security cards, passports, and other crucial documents. Organize your information into a digital wallet or secure cloud storage.

- Personal needs — Gather food, water, first-aid kits, cash, and phone chargers.

- Priceless items — Place irreplaceable mementos and other valuables like photo albums and keepsakes out of reach of floodwaters. Use waterproof plastic bags.

- Pets — Have a plan for your pets, including food, medications, identification tags and immunization records. Pack an extra leash and collar (even if they usually don’t wear one) so you can safely remove your pet no matter where you are. Research pet-friendly establishments beforehand so you’ll know where to go in an emergency.

- Home inventory — Create and store a home inventory online. Include pictures, receipts, and warranty information for your belongings. If you submit a claim, you’ll need proof you owned these things.

Secure Your Protection Today

Insurance is one of the most critical items to consider when preparing for a flood. Remember, most flood insurance policies have a waiting period of 12 to 30 days, so don’t leave it to luck.

Reach out to us to review your flood policy and make sure you are protected.

RSS Feed

RSS Feed