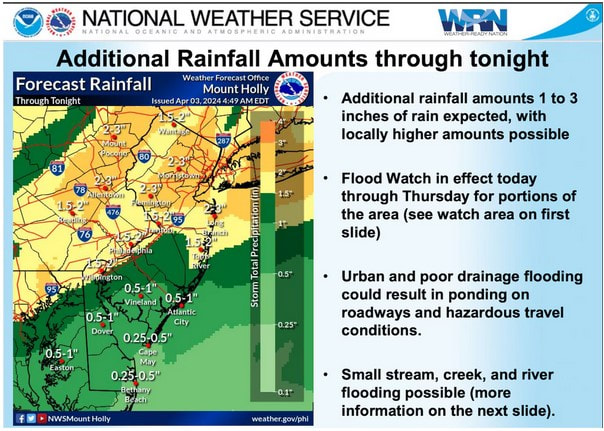

| It’s been raining on and off — mostly on — in New Jersey since early Monday with seemingly no end in sight. There is a Flood Watch in effect today through Thursday for portions of the area. The rest of Wednesday will be wet and windy. But the rain will eventually push away from our area. As the saying goes, “April showers bring May flowers.” This is the time of year when we need to be vigilant about potential flooding and protect our homes. |

3 Key Steps

- Know Your Risk. Learn more details about your home’s level of flood risk, including the type of flood zone it is in.

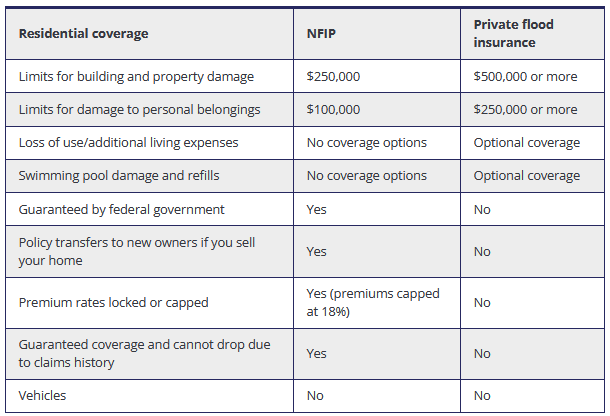

- Insure Your Property. Even if your home is in a low or moderate risk flood zone, purchase a flood insurance policy is highly recommended. It provides you with financial protection from a flood event. Flood damage isn’t covered by standard homeowners’ insurance policies.

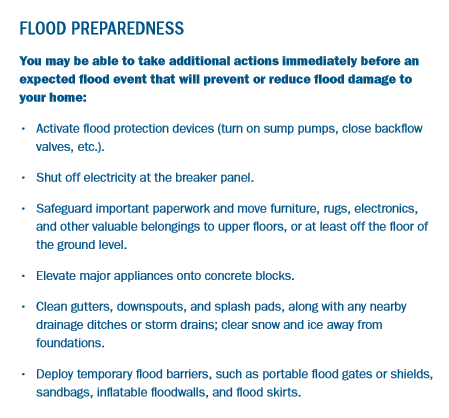

- Reduce Your Risk. Decide how to prepare your family and protect your home from flooding.

Secure Your Protection Today

Reach out to us to review your flood policy and make sure you are protected. Call us at 201-796-1881.

RSS Feed

RSS Feed