Starting with the purchase of an engagement ring, consumers should insure their ring under their homeowner’s policy (condo policy or renter’s policy). When considering a wedding venue, their insurance agent should explain the importance of purchasing insurance.

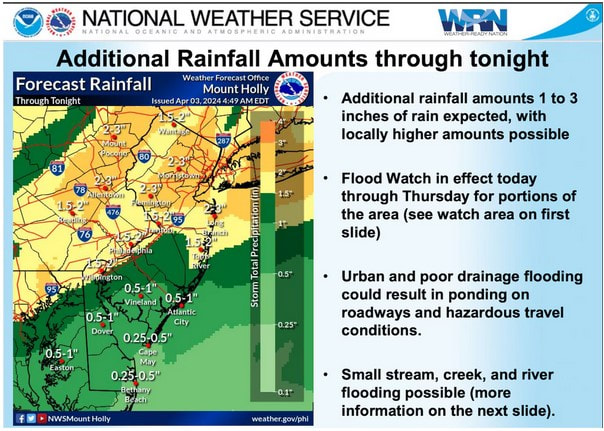

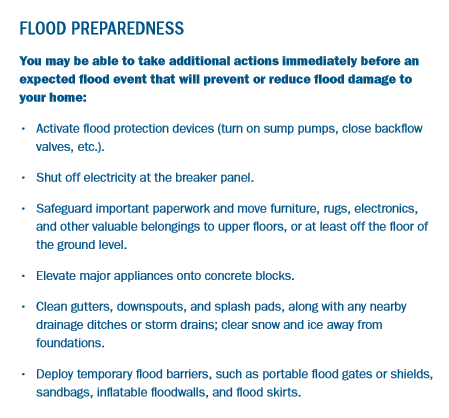

The Insurance Information Institute suggests couples explore Special Event Insurance. Special event insurance covers cancellations necessitated by adverse weather and natural disasters, such as hurricanes. Most policies also provide coverage for cancellation due to the death, illness or serious injury of a key participant in the event, such as the groom or a member of the immediate family. Also, if an officiant (such as a minister or rabbi), or a key vendor (like the caterer, florist or photographer) does not show up, special event insurance allows you to recover some of the costs.

Special event insurance riders may include coverage for:

- Military service – Provides coverage in the event the bride or groom is in the military or active reserves and is suddenly called to duty.

- Gowns and tuxedos – Provides coverage if your bridal salon goes out of business, or if the clothing is damaged.

- Gifts – If gifts are not covered by your homeowners or renters insurance policy, this provides protection against their theft or damage.

- Honeymoon – Provides coverage if you need to cancel your trip due to illness, bad weather or other circumstances.

- Professional counseling – Covers treatment of severe emotional stress due to the cancellation or postponement of the event (a doctor’s note will be needed).

- Liability – Event venues generally have their own liability insurance. If you are holding the event at home, you may want to purchase liability insurance above and beyond what is provided under your homeowners policy.

Before purchasing special event insurance, check to see whether any coverage is already provided through credit cards you might be using, or through your homeowners, auto insurance or any other policies you may already have.

At Suburban, we are always here to talk with you about your policies and finding the best insurance that provides the coverage you need at the right price. Reach out and call us at 201-796-1881.

RSS Feed

RSS Feed