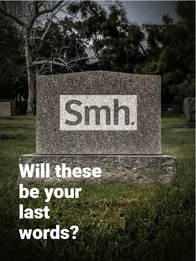

Texting is the most alarming distraction. Sending or reading a text takes your eyes off the road for about 5 seconds. At 55 mph, that's like driving the length of an entire football field with your eyes closed.

You cannot drive safely unless the task of driving has your full attention. Any non-driving activity you engage in is a potential distraction and can increase your risk of crashing.

In 2015, 391,000 people were injured in motor vehicle crashes involving distracted drivers and during daylight hours, approximately 660,000 drivers were using cell phones while driving. That creates enormous potential for deaths and injuries on U.S. roads. Teens were the largest age group reported as distracted at the time of fatal crashes.

NHTSA is Dedicated to Eliminating Risky Behaviors for a Safer Road

NHTSA leads the fight nationally against distracted driving by educating Americans about its dangers and partnering with the States and local police to enforce laws against distracted driving that help keep people safe.

NHTSA’s campaigns and public service announcements make the case to Americans that safe driving means driving without distractions.

Teens are the best messengers to their peers, so encourage them to speak up when they see a friend driving while distracted.

Parents first must lead by example, and never drive distracted, as well as have a talk with their young driver about distractions and all of the responsibilities that come with driving.

Educators and Employers – spread the word at your school or workplace about the dangers of distracted driving.

Make Your Voice Heard – be a voice in your community by supporting local laws and speaking out.

And it’s not just teenage drivers. State Farm says 36 percent of all drivers’ text and drive – and it’s making everyone’s costs go up.

In my mind, that means it’s up to everyone to get involved. As a parent, as an educator, as an employer, and as a citizen. We all need to make our voice be heard.

Visit the NHTSA website for more resources and to learn how you can get more involved.

RSS Feed

RSS Feed